Gold Card Military - Then there are the credits. Platinum Cardholders receive up to $200 in credits each year on airline fees of the Cardholder's choice of airline, up to $200 per year in Uber Cash applied to eligible Uber purchases in the US when your card is linked to your account

Uber, up to $100 a year in statement credit on Saks Fifth Avenue purchases (login required) and earn up to $85 in statement credit for TSA PreCheck or up to $100 for Global Entry. That's up to $600 in credits in one year.

Gold Card Military

Source: ksr-ugc.imgix.net

Source: ksr-ugc.imgix.net

Also the reward rate is better. You can earn 5x points on flights and 10x points on hotels and car rentals through Chase Ultimate Rewards® with Chase Sapphire Reserve®. When you transfer these points to certain Ultimate Rewards partners, you can get even more value out of them.

What Military Relief Does Amex Offer

Both an active duty soldier and a civilian spouse can open their own account. They do not have to be authorized users of the account. Both of your fees will be waived. Check your eligibility for MLA benefits in the MLA database.

This will allow you to double your annual benefits! The Gold Card offers perhaps the highest earning rate of any Amex card: 4 Membership Rewards® points per dollar at restaurants, plus US takeout and delivery, 4 Membership Rewards® points per dollar at US supermarkets (up to $25,000 per calendar year

on purchases, then 1 point per dollar), 3 Membership Rewards® points per dollar on flights booked directly with airlines or through American Express, and 1 point per dollar on other qualifying purchases. Finally, the Chase Sapphire Reserve® offers a great sign-up bonus: Earn 60,000 bonus points after spending $4,000 in purchases within the first 3 months of account opening.

That's $900 in travel when redeemed through Chase Ultimate Rewards®. You'll also get a $300 travel credit, lounge access and similar travel benefits. If you're looking for a luxury credit card with top-notch benefits, the Chase Sapphire Reserve® might be hard to beat.

Source: media.endclothing.com

Source: media.endclothing.com

Intro Apr On Balance Transfers

Get up to $200 in annual airline credit on flight-related purchases including tickets, baggage fees, upgrades and more. Using Airline Credit is easy - just pay for airline purchases with your Mastercard Gold Card and we'll automatically add the credit to your account.

That is all. There's no need to activate or set up an airline, and you can use the credit for as many travel-related purchases as you need until it's used up. Both the SCRA and the MLA limit the amount of interest that can be charged on lines of credit—albeit at very different rates.

SCRA explicitly includes annual membership fees in the interest calculation. To avoid violating any of these laws, American Express generally waives membership fees to eligible members of the Services. Luxury Card has changed its policy again and this time service members are in a difficult situation.

If we have a balance, we must either pay the $995 annual fee or pay the balance in full and close the card to avoid the fee. It's not a big deal for me personally, but the sailors and sailors I work with can't afford to pay off the balance and now face a ~$1000 annual fee because the luxury card changed course.

Balance Transfer Offer

Tracks suspicious activity related to the personal information you want to track, such as B. Name, address, email address, social security number, date of birth, debit/credit card numbers or other sensitive information. Whenever suspicious activity is detected, cardholders receive alerts that allow them to take immediate action to minimize potential damage.

Another useful benefit of the Mastercard® Gold Card™ is that it offers an introductory 0% APR for the first fifteen billing cycles after every fund transfer posted to your account within 45 days of account opening.

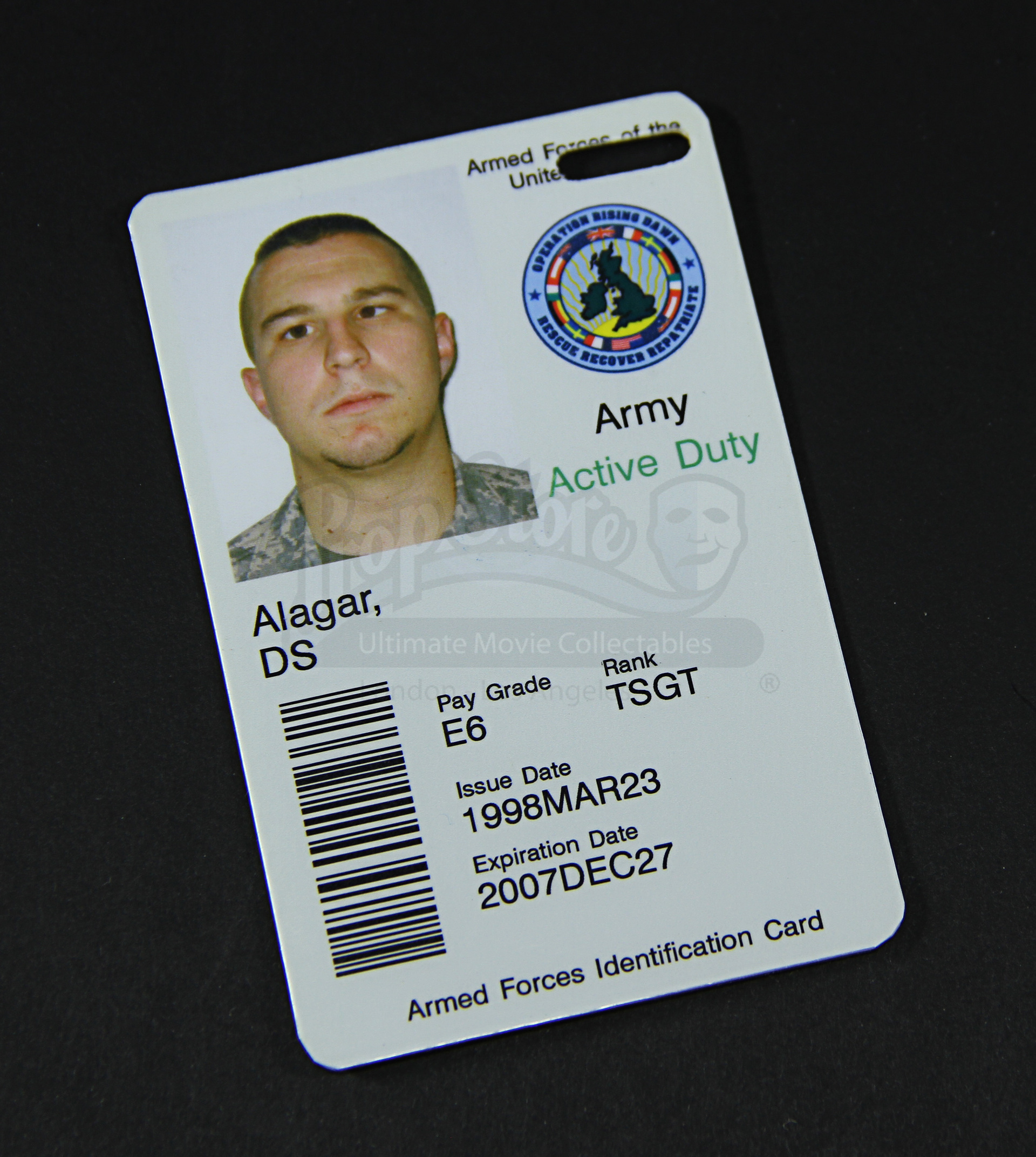

Source: images.propstore.com

Source: images.propstore.com

After that (and for deposit transfers not posted within 45 days of account opening) your APR is 19.49%. This APR varies by market based on the base rate. If you opened the card while on active duty, there's a good chance Amex will continue to waive your annual veteran's fees.

However, opening the card after active service will not waive your annual fees. With many cashback cards with no annual fee, such as the Wells Fargo Active Cash® Card B, you can easily find the same rate.

Best American Express Cards For Military Service Members

However, if you redeem these points for flights or cashback, your reward rate will increase to 2 points per dollar spent. Advertiser Disclosure: Products displayed on this website may be from companies from which ValuePenguin receives compensation.

This compensation may affect how and where products are displayed on this site (including, for example, the order in which they are displayed). ValuePenguin does not include all financial institutions or all products offered on the market.

However, you must request a waiver if you received an Amex card before duty began. And if you're an active member and don't have an Amex card, now is the time to take advantage of the premium Amex card without paying an annual fee.

0% INTRODUCTORY APR FOR 15 BILLING CYCLES on deposit transfers made within 45 days of account opening. Then the APR is 19.49%, which is a variable interest rate based on the prime rate. Fees apply for balance transfers.

Source: cdn11.bigcommerce.com

Source: cdn11.bigcommerce.com

Discover Book Perks Chat Dining

This was an incredibly generous offer and became very popular with many of us on active duty. I put $5,000 on the card for a new car (the maximum allowed by the dealer) and several friends put weddings and home improvement projects on their card because it was basically an interest-free loan.

In May last year, Barclaycard dropped the sign-up bonus for all three cards in the portfolio, and it raised a few hairs on my neck when it looked like a policy change was possible. Download the Lyft app and register your luxury card.

Lyft will automatically add $5 Lyft credit to your account when you make 3 trips per month and pay with a luxury card. Limit one Lyft Credit per calendar month. American Express offers a wide range of value credit and debit card products with annual fees ranging from $0 to $695.

If you are an eligible service member or about to enter the service, here are some of the best cards to consider. Exclusively for cardholders, the Luxury Card App brings you premium services from the comfort of your mobile device.

Bottom Line

The app is designed to inspire and manage your daily activities and needs. It allows you to manage your account and access your membership benefits and benefits, travel services and selected experiences. Upgraded Points, LLC makes reasonable efforts to maintain accurate information on the Site - and before applying for credit card offers on UpgradedPoints.com, all visitors should review the additional features of such credit cards, including, but not limited to, interest rates and annual

fees and transactions. fees and should determine the suitability of such credit cards taking into account their own individual financial situation. If you open the card while you or your spouse is on active duty, your fees will be waived under the Amex Military Lending Act or MLA guidelines.

Source: i.pinimg.com

Source: i.pinimg.com

You can confirm your MLA eligibility in the MLA database. Undoubtedly, it was too generous an offer at first and, logically, many soldiers took advantage of it. While we never recommend carrying credit card balances, when a well-known and reputable bank clearly states 0% APR in their terms and conditions, why shouldn't service members take advantage of that?

Download the Lyft app and register your luxury card. Lyft will automatically add $5 Lyft credit to your account when you make 3 trips per month and pay with a luxury card. Limit one Lyft Credit per calendar month.

Amex Gold Card Military Benefits

It pays to know your rights, especially if you are an active service member. Active duty military members can purchase some of the best cards on the market for free thanks to Amex's application of the Servicemembers Civilian Relief Act (SCRA) and the Military Lending Act (MLA).

Advertiser Disclosure: Many of the credit card offers that appear on this site come from credit card companies from whom we receive compensation. This compensation may affect how and where products are displayed on this site (including, for example, the order in which they are displayed).

This website does not include all credit card companies or all credit card offers available. More information about our advertisers can be found here. In addition, as an Amazon partner, we earn from qualified purchases. The primary benefit of the Amex Gold Card, which is specific to the military, is the $250 annual fee waiver for active duty, Guard and Reserve members on active duty assignments of more than 30 days and military spouses.

Other key benefits include a welcome bonus of 60,000 points after $4,000 in minutes during the first 6 months of card membership. 4 Restrictions, limitations and exclusions apply. Once your account is approved, we'll send you a Benefits Guide that includes a full explanation of coverage and details on specific time limits, eligibility, and documentation requirements.

Source: i.ebayimg.com

Source: i.ebayimg.com

Is The Mastercard® Gold Card™ Worth It?

Click here for mobile phone protection details. Click here for details on Mastercard Global Service®. Please note that calls from a mobile phone may incur a charge. No, the Mastercard® Gold Card™ does not waive the annual fee for active military personnel.

Although Barclaycard used to offer perks like 0% APR and no annual or late fees to active duty military cardholders, it has since removed those perks. However, there are still certain military benefits to the Mastercard® Gold Card™ that are mandated by the Servicemembers' Civilian Relief Act (SCRA) - these include things like a higher interest rate during and after active military service.

If you're looking for a credit card for everyday use, we don't think the Mastercard® Gold Card™ is worth it. The premium rates for off-the-go purchases are low, and we don't think the benefits of the card outweigh the ridiculously high annual fee.

Other premium credit cards offer more and at significantly lower prices. The Military Money Manual connects members of the US military with the best military credit cards available. I am an active duty officer in the US Air Force and I am investing in financial independence by the age of 40.

American Express® Gold Card

This site has been owned and operated by veterans since 2012. Thank you for your support! While the Amex Platinum is loaded with benefits, the American Express® Gold Card offers a balanced mix of solid benefits and solid returns.

The card charges a $250 annual fee and offers nearly that much in annual statements. This card is an excellent addition to the Amex Platinum card. The Gold Card collects more points (4x versus 1x) in restaurants and American supermarkets than the Platinum Card.

I compared Amex Gold vs Amex Platinum to find out which is better for the military. From the app: “Based on your history of credit card balance transfers, American Express welcome offers, introductory APR offers, or the number of cards you've opened and closed, you're not eligible for the welcome offer.” Hmmm… While most of the benefits are the same,

cardholders get just 2% of the ticket redemption value with no blackout dates or seat restrictions. 1.5% value for redemptions. Earn one point for every dollar spent. Plus, you get just $100 in annual travel credit.

How To Get Military Benefits From American Express

And the card is not made of gold. The American Express waiver process depends on when you opened the card. You must apply for SCRA relief for cards opened prior to active duty. The process should be automated to facilitate legal aid.